This is the most well-predicted recession, not just in a long time, but possibly ever.

Lenders aren’t making the same mistakes as they did prior to the great recession.

Loans are well collateralized.

Appraisals are conservative.

Underwriting is staying “in the box”.

And outside of some limited examples with crypto — collateral values are holding.

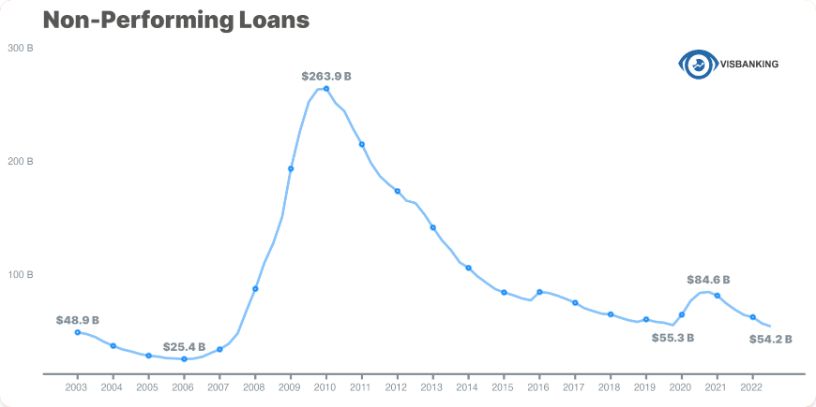

This gives Risk Officers plenty of time and bandwidth to look for warning signs of increasing Non-Performing Loans (NPLs).

Right now, they are looking for 3 levels of severity:

1: 30+ days past due

2: 90 days past due, but still accruing interest

3: Non-accrual status

Thanks to higher interest rates,

Whenever these are spotted,

The bank is able to adjust and price in the risk accordingly.

On the other side of the coin,

Consumers are shockingly healthy at this point.

Demand is high,

Employment is high,

And layoffs seem to be isolated to tech.

All indicators that NPLs are unlikely to increase drastically.

A recession may be looming,

But a sudden, drastic rise in NPLs is NOT.

—

Follow Brian on Linkedin: Brian Pillmore